Tally ERP 9 with GST Complete Advance Course

Why take this course?

🎓 Course Title: Tally ERP 9 with GST Complete Advanced Course

Course Headline:

Unlock the Secrets of Financial Mastery with Tally ERP 9 - Your Ultimate Guide to Goods and Services Tax (GST) Compliance!

Course Description:

Embark on a comprehensive learning journey with our "Tally ERP 9 with GST Complete Advanced Course," designed to equip you with an in-depth understanding of Accounting, specifically within the Tally framework, and how to seamlessly navigate the complexities of Goods and Services Tax (GST).

Why Choose This Course?

- Real World Application: Dive into the world of practical accounting with real-life examples that not only enhance your understanding but also boost your confidence for job interviews or to manage your own accounting business.

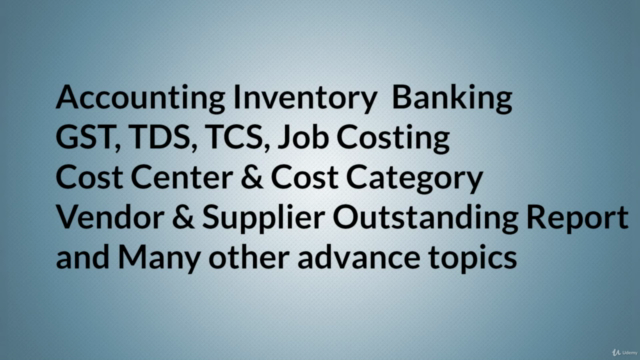

- Complete Depth Knowledge: Gain an in-depth knowledge of all features of Tally, from basic transactions to advanced functionalities like Cost Centers, Job Costing, and Taxation.

- Practical Approach: Learn through practical examples that mirror real-world business scenarios, ensuring you can apply your knowledge directly to a job or business.

- Skill Enhancement for Career Advancement: Whether you're aiming to secure a new role in Accounting & Finance or seeking to enhance your current skill set, this course will provide you with the tools and knowledge necessary to excel.

- Entrepreneurial Opportunities: Upon completion, you'll be well-equipped to start your own accounting business, handling complex financial tasks such as GST, TDS & Income Tax Returns for small businesses or shops.

Course Structure:

Basic Level:

- Basic of Accounting

- Accounting & Inventory Masters

- Chart of Accounts (List of Ledger & their use)

- All Accounting & Inventory Vouchers

- Bank Reconciliation (Banking)

Taxation:

- Goods & Services Tax (GST)

- Eway Bill

- TDS, TCS

- Payroll (ESIC, PF, Gratuity)

Advanced Level:

- Cost Centre, Cost Category

- Job Costing

- Budgets

- Price List

- Outstanding Reports (Accounts Payable & Accounts Receivable)

- Multi Currency

- Interest Calculation

- Purchase, Sales Order Processing

- Bill of Material

Expert Insight:

Our course is crafted and led by the experienced Mr. Mahavir Bhardwaj, who brings over 18 years of expertise in accounts & finance from his work with leading MNCs. His real-world insights are directly applied to this course, ensuring you benefit from his extensive industry knowledge and practical experience.

Learning Philosophy:

We believe that understanding the intricacies of your business is fundamental to effective accounting. Our approach mirrors this principle by focusing on various business operations and their corresponding reporting needs. As an accountant, your role is to first understand the business and then record transactions in Tally accordingly. This philosophy is woven throughout our course, providing you with a robust learning experience that aligns with real-world demands.

Enroll now to transform your career in accounting and finance! 🚀✨

Course Gallery

Loading charts...