Master the Art of Trading: Stock Sutra By Ex-IAS/Allied

Why take this course?

Looks like you've provided a comprehensive outline for a trading education course, covering various aspects of stock trading, including charts, risk management, and specific market types such as stocks, stock futures, forex, and commodities. This course seems to be designed to take the learner through a structured path from understanding basic charting to applying advanced trading strategies.

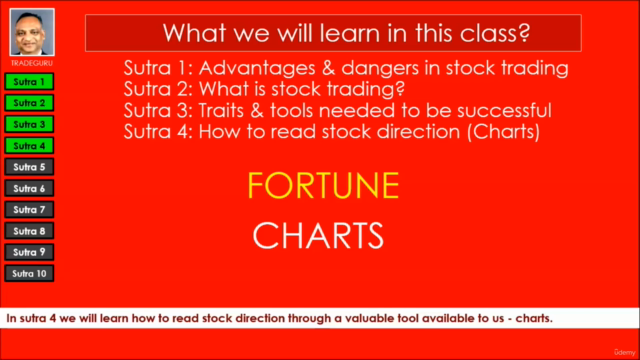

Here's a summary of what each step/sutra entails according to your outline:

-

Introduction to Stock Market Trading: Understanding the basics, types of markets, and how to start with trading.

-

Understanding Technical Analysis: Learning about price patterns, volume patterns, and what the charts are trying to communicate.

-

Importance of Charts: How charts can help in predicting stock trends, the structure of a chart, and the types of information they contain.

-

Installation and Usage of Charting Software: A guide on how to install and use the software for reading stock charts.

-

Technical Indicators: An introduction to various indicators like E13, MACD Histogram, ADX, Force Index Oscillator, Stochastic Oscillator, Channels, etc., and their significance in trading.

-

Risk Management (RM): Understanding the concept of risk management, its importance, benefits, how to use it, and the fundamentals of managing risks.

-

Trading System (TS): Learning about trading systems, their uses, benefits, when to trade, what to buy, how to calculate risk & reward, and when to sell. The course also includes a core strategy and rules for managing trades.

-

How to Trade Stocks: A guide on the stock future market, its features, investment profit returns, and risk management rules.

-

How to Trade Currency/Forex: An overview of currency trading, its features, what and when to buy or sell, and risk management strategies.

-

How to Trade Commodity: Understanding commodity trading, its features, trading rules, and managing risks.

-

Dancing with Stocks: This step likely involves applying the knowledge gained from the previous lessons in a dynamic market environment.

Each step is designed to build upon the previous one, ensuring that learners develop a comprehensive understanding of stock market trading before moving on to more complex strategies and market types. The course also emphasizes risk management as a core component throughout all trading activities.

If you're looking to implement this course structure, ensure that each step is detailed and provides practical examples or exercises where possible. Interactive elements like quizzes can help reinforce learning and assess comprehension. Additionally, it would be beneficial to provide real-time data or a simulator for learners to practice their skills without risking actual capital.

Course Gallery

Loading charts...