Master in TDS on Salary

Why take this course?

🚀 Course Title: Master in TDS on Salary: A Complete Guide on Tax Deduction at Source for Salary Income

🎓 Course Description: Are you an employer, HR professional, finance officer, or a working individual seeking to navigate the intricacies of Tax Deduction at Source (TDS) on salary? Look no further! Our comprehensive online course, crafted by the renowned tax expert Saurabh Jog, will empower you with a deep Theoretical Understanding of the Income Tax Law as it pertains to TDS on Salary.

📚 Course Structure: This course is meticulously designed to cover all critical aspects of TDS on Salary, ensuring you gain both theoretical knowledge and practical proficiency. Here's what you can expect to master:

-

🔎 Calculation of Taxable / Exempt Salary:

- Learn how to distinguish between taxable and non-taxable components of your salary.

-

Various Taxable / Exempt Allowances & Perquisites:

- Understand the nuances of different allowances and perquisites that can affect your TDS liability.

-

📊 Income Tax Rules regarding Valuation of Perquisites:

- Get to grips with the valuation rules for perquisites under the Income Tax Act.

-

Deductions available to an Employee:

- Discover the deductions you or your employees are entitled to claim, reducing the overall tax burden.

-

Calculation of TDS in Payroll Processing:

- Learn how to correctly calculate and deduct TDS during the payroll process.

-

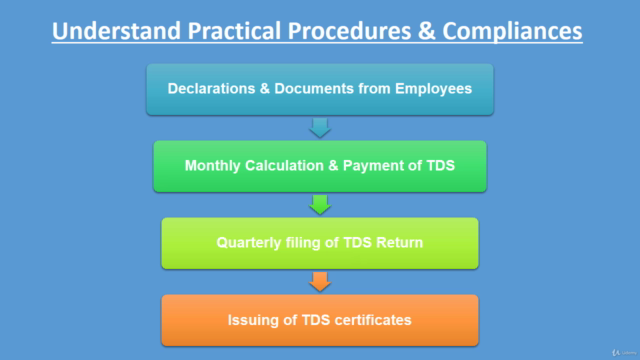

📈 Documentation & Procedures to be followed under Income Tax Act:

- Ensure compliance with all documentation and procedures as mandated by the Income Tax Act.

-

Preparation of Quarterly TDS Return:

- Master the process of preparing and filing quarterly TDS returns accurately and on time.

-

Standard Operating Procedures (SOPs) to be followed in TDS Process:

- Implement SOPs for a smooth, efficient, and error-free TDS process.

Why Choose This Course? ✅ Engage with real-world scenarios and case studies that highlight the application of TDS rules on salary. ✅ Benefit from Saurabh Jog's expert insights and years of experience in tax law. ✅ Access to downloadable resources, templates, and checklists for easy reference and practical implementation. ✅ Interactive quizzes and assessments to test your understanding and retention of the concepts taught. ✅ Gain the confidence to manage TDS on salary with the knowledge that you're fully compliant with current tax laws.

🎉 Take the first step towards mastering TDS on Salary today! 🌟

By enrolling in this course, you're not just preparing to comply with tax regulations; you're setting a foundation for financial accuracy and savings for yourself or your organization. Enroll now and transform your approach to TDS on salary with our Master in TDS on Salary course! 🎓✨

Enroll Now and unlock the door to hassle-free TDS compliance! 🏆

Course Gallery

Loading charts...