Introduction to Futures & Options trading- A 360 degree view

Why take this course?

🎉 Introduction to Futures & Options Trading: A 360 Degree View 📚

Course Instructor: Ravi Kumar K

Course Headline: Stock Trading vs Futures Trading, Options Trading, Index Options, Stock Options, Financial Trading, and Option Strategies

Dive into the world of financial markets with our comprehensive course that offers a complete 360-degree view of Futures & Options trading. Whether you're a beginner or looking to expand your knowledge, this course is designed to equip you with the necessary skills and understanding to navigate the exciting and complex realms of stock and futures markets.

What You Will Learn:

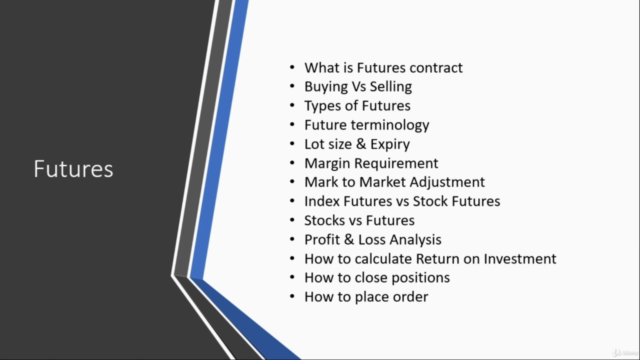

🎓 Futures Trading Fundamentals:

- Basic Terminology of Futures: Get acquainted with the essential terms and concepts in futures trading.

- Ordering and Closing Futures: Learn how to effectively place orders, close positions, and manage your portfolio.

- Margin Requirements and Risk Management: Understand the financial commitments and risk management strategies specific to futures trading.

📈 Futures vs Index Futures:

- Index Futures vs Stock Futures: Discover the key differences between trading index futures and stock futures.

🚀 Futures Hedging Strategies:

- Explore various hedging techniques to protect your portfolio against market volatility.

📊 Stocks vs Futures:

- Compare and contrast the two markets, their risks, rewards, and trading styles.

📈 Options Trading Basics:

- Grasp the foundational concepts of options terminology, including calls and puts.

💰 Option Pricing and Models:

- Dive into the intricacies of option pricing, with a focus on the famous Black-Scholes model.

📈 Real-World Worksheets and Graphs:

- Interactive worksheets and graphs will help you visualize option buying and selling scenarios.

🛠️ Option Strategies for All Market Conditions:

- Learn bullish, bearish, and neutral market strategies to suit any market condition.

⏰ Time Decay, Volatility, and Options Pricing:

- Understand how time decay, volatility, and other factors influence options pricing.

📱 Placing Options Orders:

- Get hands-on experience with placing various types of options orders.

🎴 Master Strategies Like Straddles, Strangles, Spreads, and More:

- Study advanced strategies such as straddles, strangles, bull call spreads, bull put spreads, bear call spreads, and bear put spreads.

By the end of this course, you will have a solid grasp of the key concepts, tools, and techniques necessary to make informed decisions in Futures & Options trading. You'll be able to assess risk, reward, and capital requirements effectively, preparing you for the dynamic F&O markets.

Join us on this journey to master the art of futures and options trading! 🌟

Course Gallery

Loading charts...