Introduction to Futures & Options

Why take this course?

📚 Introduction to Futures & Options: Master Derivatives with Starweaver Instructor Team

🚀 Course Headline: Dive into the World of Derivatives! 🌐

Embark on a comprehensive journey into the realm of financial derivatives with our "Introduction to Futures & Options" course. This course is meticulously crafted to provide you with a solid understanding of futures and options, the cornerstones of modern financial markets. 🏛️✨

Course Highlights:

- Foundational Knowledge: Learn what futures and options are and their role in financial markets.

- Detailed Explanation: Understand the common features, essential characteristics, and how these derivatives are priced. 📊

- Real-World Applications: Discover how businesses use futures and options to manage risk and engage in speculation. 🎯

- Hands-On Learning: Engage with 27 lectures across 6 sections, each designed to build your knowledge step by step.

Course Structure:

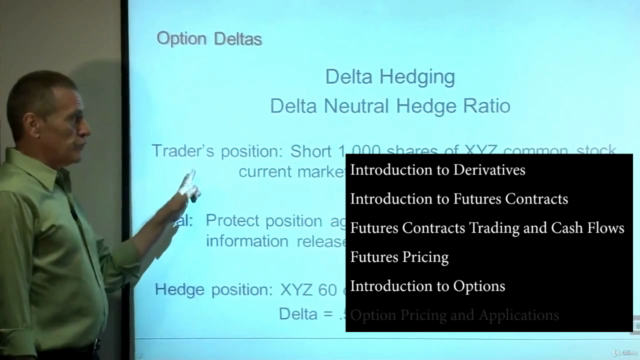

- Introduction to Derivatives: A primer on the world of financial derivatives.

- Introduction to Futures Contracts: Dive into the mechanics and functions of futures contracts.

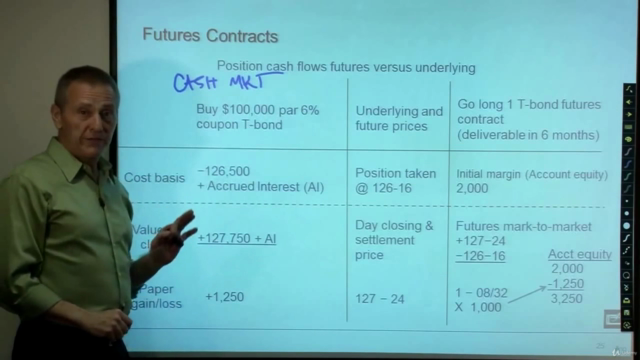

- Futures Contracts Trading and Cash Flows: Learn about trading strategies and the associated cash flows.

- Futures Pricing: Analyze the factors that influence futures contract pricing.

- Introduction to Options: Uncover the basics of options, their types (calls and puts), and how they differ from futures.

- Option Pricing and Applications: Explore the models used to price options and their practical applications in business.

Who Is This Course For?

This course is tailored for finance professionals at any level within a business, as well as those working in financial institutions such as:

- Retail and commercial banks

- Investment banks

- Hedge funds

- Family offices

- Investment management firms

- Insurers and reinsurers

🧑💼 Instructor Expertise:

Led by a seasoned capital markets practitioner with extensive hands-on experience in sales, trading, and financial markets analysis, this course is a testament to Starweaver's commitment to excellence. 🏅

Starweaver, a leader in professional training, has collaborated with top global financial institutions and tech companies, including many from the list above. Our courses are designed to cater to a wide range of learning preferences, from new hires to seasoned professionals seeking immersion and leadership skills. 🌟

Ready to elevate your financial expertise? Join us at Starweaver, where we transform knowledge into action. Whether you're looking for live streaming education or seeking to understand which courses align with your career goals in technology or business, Starweaver Journey Builder is your gateway. 🚀

Discover more about our offerings at starweaver.com. 🌐

Happy learning, and let's unlock the potential of derivatives together! 🎉

Course Gallery

Loading charts...