Intermediate Accounting Made Easy

Why take this course?

🌟 Intermediate Accounting Made Easy by Rich Veltrini 🌟

Unlock Your Full Potential in Accounting

Marketplace demand for skilled accountants has never been higher. And at the heart of this need lies Intermediate Accounting – a course that demystifies complex financial concepts and transforms them into actionable knowledge.

Intermediate Accounting is often considered the most challenging accounting course due to the breadth and complexity of topics it covers. Rich Veltrini's approach simplifies these complexities, taking students from strategic concepts right down into the minutiae of recording a transaction. 📊

With most lectures ranging from 8-12 minutes, you can learn at your own pace, making this course ideal for busy professionals and eager learners. Rich's methodical approach is grounded in basic principles such as matching, conservatism, and consistency, which are essential when faced with a complex transaction.

Your Instructor: Rich Veltrini

Rich Veltrini isn't just any accountant; he's a CPA, MBA, and former Big-4 accountant who uses his well-paced lectures and clear illustrations to bring nearly 30 years of experience in finance and technology leadership roles directly to you. His teaching style makes even the most complex topics accessible.

This course is perfect for:

- Experienced Bookkeepers: Who want to elevate their accounting expertise.

- Novice Accountants: Looking to expand their skills set.

- A Compliment to College Courses: For those enhancing their academic understanding of intermediate accounting.

- Aspiring Accounting Professionals: Seeking to begin a career in this exciting field.

Course Highlights

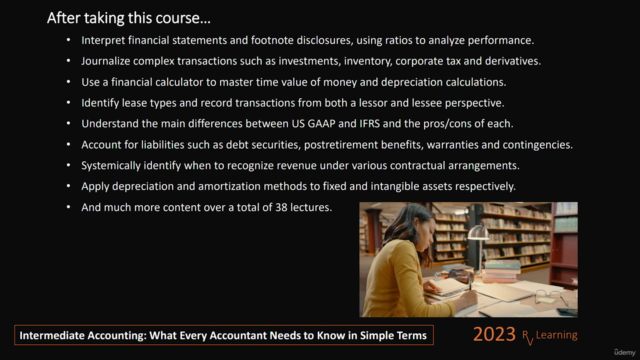

The course covers a comprehensive range of advanced topics, including but not limited to:

- Journal entries / trial balance / T-accounts / double-entry accounting

- Financial statements and footnotes

- Disclosure trends and techniques

- Postretirement benefits / debt securities / tax

- Lease accounting for both lessors and lessees

- Warranty and contingency accounting

- Intangible assets / fixed assets / investment accounting

- Inventory cost flow methods and valuation

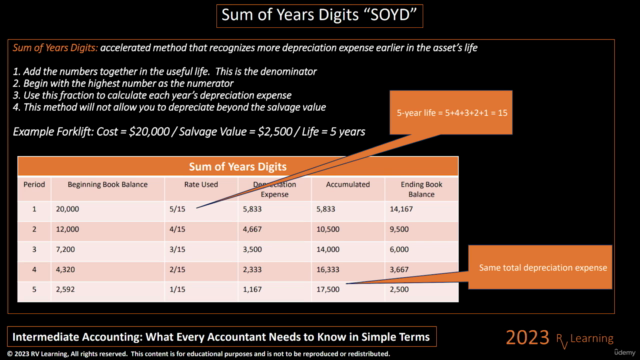

- Depreciation and amortization methods

- Time value of money calculations

- Ratio analysis

- Earnings per share calculations

- Securities & Exchange Commission (SEC) filings

- Governance & regulatory bodies

- Handling errors, changes in principles and restatements

What You'll Learn Beyond the Core Topics:

This course doesn't just stop at covering the basics. Here's a glimpse of the additional skills you'll acquire:

- A systematic approach to revenue recognition 💸

- Insights into how real companies manage complex financial instruments disclosure

- Understanding the story behind financial ratios

- Developing the ability to figure out journal entries based on given facts

- Distinguishing between the economic substance and legal form of a transaction

- Calculating, valuing, and recording deferred tax assets and liabilities

- Applying learnings to critically analyze financial statements and footnotes 📈

- Mastering financial calculator skills on two popular models

- Learning how the accounting cycle ties all the concepts together into a cohesive system

Learning Materials

Rich Veltrini's course is rich with downloadable materials, 150+ visual illustrations of key concepts, and a comprehensive glossary to ensure you have all the tools necessary for success.

Enroll today and take the first step towards mastering Intermediate Accounting. Whether you're a seasoned professional or just starting out in accounting, this course is designed to challenge your understanding, refine your skills, and prepare you for the complexities of financial management. 🚀

Take command of your accounting career and let Rich Veltrini guide you through one of the most important subjects in finance with "Intermediate Accounting Made Easy." 🏆

Course Gallery

Loading charts...