How To Select Banknifty Strike Price To Trade

Why take this course?

🎓 Course Title: How To Select Banknifty Strike Price To Trade

Course Headline:

Know the Secret of Strike Price Selection for Mastering Index Options Trading

Course Description:

Dive into the world of Banknifty and Nifty options trading with our comprehensive online course, crafted specifically for traders eager to master the art of selecting the perfect strike price. Whether you're navigating sideways markets or riding the waves of a trending market, understanding how different strike prices can influence your trades is crucial.

🔍 Course Objectives:

- Learn to identify and select daywise strike prices for Index Options trading.

- Grasp the concepts of At The Money (ATM), Out Of Money (OTM), and In The Money (ITM) options.

- Analyze how the prices of ATM, ITM, and OTM options behave.

- Comprehend the intrinsic value and time value of options.

- Explore the differences between weekly and monthly expiry options.

Why This Course?

As an aspiring or experienced trader, understanding the nuances of strike price selection is essential for your success in options trading. This course demystifies the process, enabling you to make informed decisions based on market conditions and the specific characteristics of each option. Whether you're a buyer or seller in the options market, this course will equip you with the knowledge to navigate the complexities of options trading confidently.

🎥 Course Curriculum:

-

Introduction to Banknifty and Nifty Options:

- Understanding what index options are and how they differ from stocks.

- The significance of selecting the right strike price.

-

Types of Strike Prices:

- Exploring At The Money, Out Of Money, and In The Money options.

- Real-world examples illustrating each type.

-

Dynamics of Option Pricing:

- How the prices of ATM, ITM, and OTM options react to market movements.

- The impact of time value and intrinsic value on your trades.

-

Strategies for Daily Strike Price Selection:

- Techniques to pick the most suitable strike price each day.

- Factors influencing strike price selection based on expiry cycles.

-

Expiry Options:

- The difference between weekly and monthly expiry options.

- How expiry affects your trading strategy.

-

Final Thoughts:

- Recap of the key takeaways from the course.

- Strategies to apply what you've learned for consistent profitability in your trades.

Enroll now and embark on a journey to becoming an expert in Banknifty and Nifty options trading. With this course, you'll have a clear understanding of how to select the most appropriate strike price, thereby enhancing your trading strategy and potentially boosting your returns. 🚀

Join us today and transform your trading approach with How To Select Banknifty Strike Price To Trade! 📈🎓

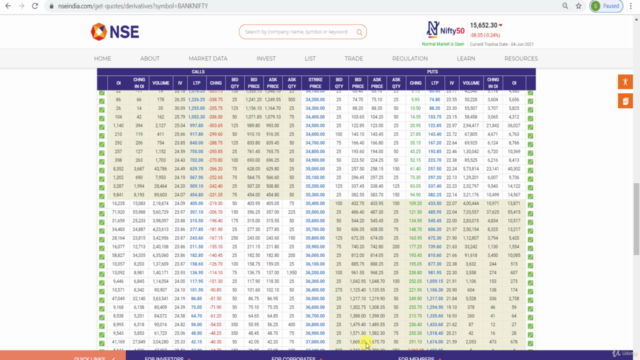

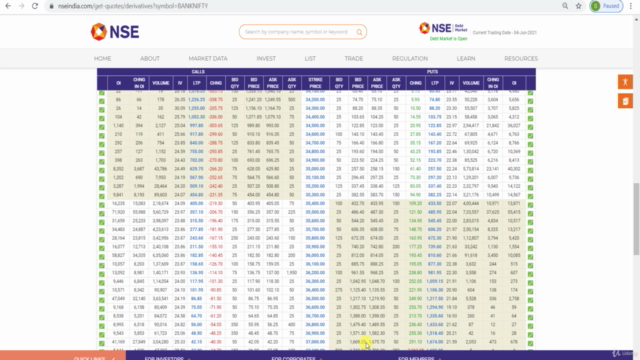

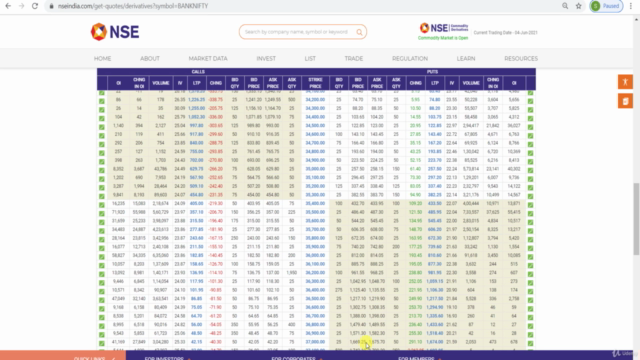

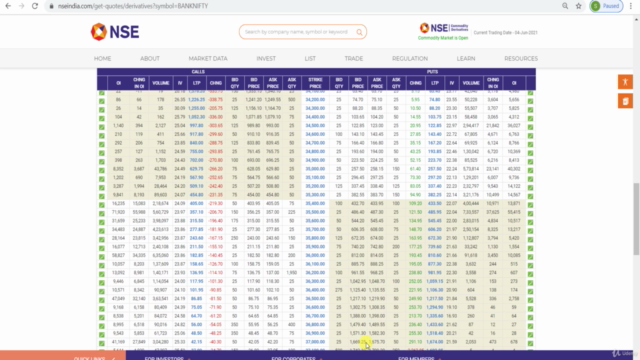

Course Gallery

Loading charts...