Real Estate Investment Masterclass: modeling & concept

Learn how to analyze any Real Estate Investment opportunity Step by Step. Handle Concepts and Excel Modeling.

4.54 (27 reviews)

325

students

5 hours

content

Jun 2024

last update

$19.99

regular price

Why take this course?

🚀 [2024] Real Estate Investment Masterclass: Modeling & Concept 🏘️

Description:

Are you ready to unlock the potential of real estate investment with confidence and expertise? If so, welcome to the "Real Estate Investment Masterclass: Modeling & Concept" – your comprehensive guide to analyzing any Real Estate Investment opportunity with precision and clarity. This course is designed for everyone from beginners to seasoned professionals who want to master the art of real estate finance and Excel modeling.

Why Take This Course? 🤔

- 🤖 Understand RE Finance Concepts: Dive into the fundamental concepts of Real Estate investment, including CAP rate, Net Operating Income (NOI), Operating Income, Internal Rate of Return (IRR), and more.

- 👨💼 Real-World Exposure: Gain insights into the strategies used by investors and large Real Estate Investment Funds – knowledge drawn from Leroy's firsthand experience working within a top RE fund.

- 🧠 Excel Mastery: From basic to advanced formulas, you'll become proficient in using Excel for real estate investments, ensuring you can handle complex financial models with ease.

- 👨🏫 Hands-On Learning: With a wealth of exercises and a detailed Case Study, you'll apply what you learn in real-time, preparing you for the demands of the industry.

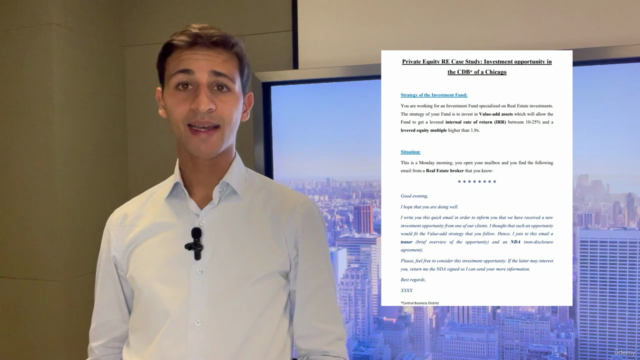

- 📚 Final Assessment: Test your skills with a comprehensive Real-Life Private Equity Real Estate Case Study Exam, putting your newfound knowledge into practice.

Course Highlights:

- Comprehensive Overview: Understand the landscape of Real Estate Investment and the various strategies employed by successful investors and funds.

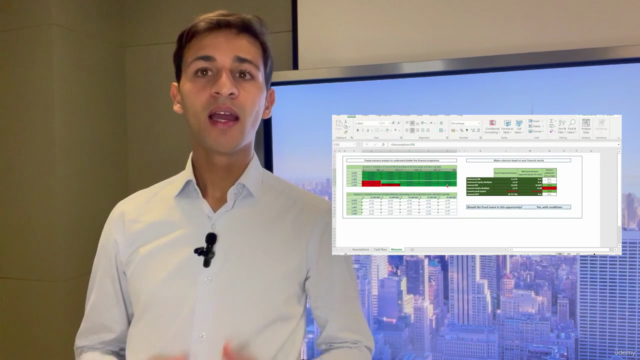

- Excel Modeling: Learn how to create a Dynamic Financial Model for Real Estate on Excel, enhancing your ability to make informed investment decisions.

- Exercises Galore: Engage with numerous exercises designed to reinforce your understanding of real estate concepts and Excel skills.

- Capstone Project: Tackle a full-fledged Case Study that simulates a professional investor's evaluation process for a RE asset within an investment fund's portfolio.

What You Will Learn:

- The intricacies of Real Estate Investment opportunities and how to analyze them effectively.

- The key financial concepts necessary for informed decision-making in real estate investments.

- Advanced Excel skills tailored specifically for Real Estate finance analysis.

- How to build a dynamic and flexible financial model that can adapt to various investment scenarios.

By the End of This Course, You Will:

- Be equipped with the knowledge to analyze any Real Estate Investment opportunity independently.

- Have a solid understanding of how to apply Excel in real estate finance.

- Possess the skills to confidently make informed decisions regarding your investments.

Embark on your journey to becoming a savvy Real Estate investor today! 🌟

Course Gallery

Loading charts...

Related Topics

4906230

udemy ID

30/09/2022

course created date

01/01/2023

course indexed date

Bot

course submited by