财务建模:Excel 中的完整财务课程 - 金融

Why take this course?

🚀 课程标题: Financial Modeling Mastery: The Complete Excel Financial Course - Excel Finance Training

👩🏫 导师介绍: Yassine Rochd, with years of experience in financial modeling and valuation, brings real-world expertise to this comprehensive course. His extensive background in investment banking, private equity, and corporate finance will equip you with the practical skills needed to excel in your financial analysis endeavors.

📈 课程头线: Dive into Practical Financial Modeling with Excel: Craft Business Plans, Valuations, and Models for Private Equity, LBOs, and Beyond - Your Guide to Mastering Finance on Excel

课程概述: Are you captivated by the world of finance, particularly in areas like private equity, LBOs, financial control, or corporate finance? If so, you've likely recognized that financial modeling is a critical skill in these fields. Whether you're drafting business plans, preparing financial statements, or appraising companies, proficiency in financial modeling with Excel is indispensable.

This all-encompassing course on Excel Financial Modeling is designed to impart the knowledge, skills, and best practices necessary to create clear and well-structured Excel models that meet the expectations of investment banks, private equity funds, and financial management teams.

🎓 课程亮点:

- Comprehensive Understanding: Learn the fundamental concepts of financial modeling, including investment valuation, forecasting, and financial statement analysis before diving into advanced Excel techniques.

- Real-World Application: Engage with practical case studies that reflect real-world financial scenarios, providing you with hands-on experience in creating sophisticated models.

- Expert Guidance: Yassine Rochd will guide you through each step, ensuring you understand both the theoretical underpinnings and the practical applications of financial modeling in Excel.

- Industry Standards: Master the standards and rules that govern professional financial modeling, ensuring your models are robust, reliable, and ready for a variety of investment scenarios.

📊 课程内容:

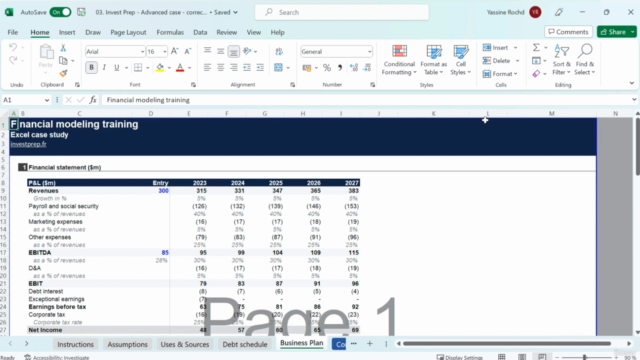

- Designing Comprehensive Financial Models: Learn to incorporate various investment scenarios, multiple layers of debt, and diverse features into your Excel models.

- Creating Financial Statements: Develop clear funding use of proceeds and waterfall charts that communicate the flow of money in and out of a company.

- Company Valuation: Understand and apply the principles of valuing companies based on comparable transactions, with a focus on standard EBITDA multiples.

- Calculating Investment Metrics: Compute the Internal Rate of Return (IRR) and perform sensitivity analysis to evaluate investment outcomes under different assumptions.

🔍 Who is this course for?

- Aspiring or experienced professionals in finance who want to sharpen their Excel skills and enhance their financial modeling abilities.

- Individuals looking to enter the fields of investment banking, private equity, corporate finance, or financial management.

- Anyone interested in gaining a solid understanding of financial control, financial analysis, or trading within the context of private equity, LBOs, and M&A transactions.

🚀 取得目标: Upon completing this course, you will not only have a strong command of Excel for financial modeling but also be equipped with the skills to analyze financial data accurately and make informed investment decisions. You'll be ready to tackle complex financial problems and contribute meaningfully to your organization or to potential clients.

📅 课程计划:

- Week 1: Introduction to Financial Modeling and Excel Basics

- Week 2: Financial Statements and Understanding Business Dynamics

- Week 3: Building a Basic Three-Statement Model

- Week 4: Advanced Modeling Techniques and Sensitivity Analysis

- Week 5: Valuation Models and Case Studies

- Week 6: Final Project - Comprehensive Financial Model

💡 加入这门课程,开启你的财务建模之旅,并在Excel上取得卓越!

Course Gallery

Loading charts...