Conceptual Fundamentals - LBO Modeling

Why take this course?

🚀 Master the Art of Leveraged Buyout (LBO) Modeling with Excel!

Hey there, aspiring financial analysts and private equity enthusiasts! Are you ready to dive deep into the world of LBO modeling? If you've got a grasp on the basics of finance but are looking to elevate your skills to the intermediate level, this is the course for you. 🌟

Conceptual Fundamentals - LBO Modeling with Kashyap Rajagopal

✨ Course Highlights:

- Real-World Application: Learn to model LBOs using Excel – the tool that every PE investor relies on!

- Intermediate Level: Assuming you're familiar with basic financial concepts, this course is designed to take your understanding to the next level.

- Perfect for Interviews: Whether you're an interview candidate at a top firm or looking to sharpen your skills for your current role, this course will set you apart.

- Expert Guidance: Led by Kashyap Rajagopal, an experienced finance professional and educator, you'll gain insights that go beyond the surface.

What You'll Learn:

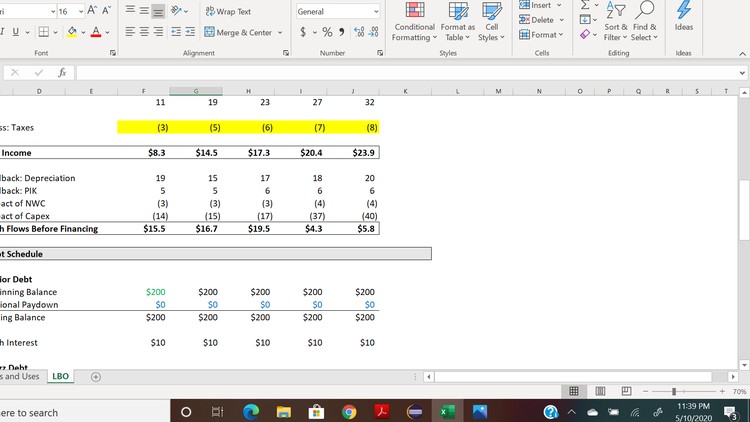

📈 LBO Modeling Techniques: Gain a thorough understanding of how to approach and structure a Leveraged Buyout deal using Excel.

- Valuation Methodologies: Learn various valuation techniques and how to apply them in the context of an LBO.

- Financial Modelling Shortcuts: Master shortcuts and efficient ways to model, saving you time while making your analyses robust.

- Investment Rationale: Understand how to build a compelling investment thesis that aligns with the financial projections in your model.

- Sensitivity Analysis: Learn how to incorporate sensitivity analysis to showcase different scenarios and their impact on the deal's viability.

Course Breakdown:

- Introduction to LBOs: We'll kick off by demystifying what an LBO is and the role it plays in the investment world.

- LBO Structuring: You'll learn how to structure an LBO deal, including the sources and costs of debt, equity requirements, and deal feasibility.

- Financial Modeling in Excel: This is where you'll put your Excel skills into action, building a detailed financial model for an LBO.

- Deal Driving Factors: Discover what drives the success of an LBO and how to articulate this in your modeling.

- Case Studies: Through real-world examples, you'll see how successful LBOs are executed and analyzed.

Why Choose This Course?

🎓 Interactive Learning: With a combination of video lectures, quizzes, and exercises, this course is designed for dynamic learning. 🌍 Global Perspective: Learn techniques that are not just applicable in any market but will also align with global financial standards. 🔥 Practical Application: This isn't just theory; you'll be applying what you learn to actual deals, giving you a practical understanding of LBOs.

Ready to transform your financial analysis skills and impress interviewers with your advanced knowledge of LBO modeling? Enroll in "Conceptual Fundamentals - LBO Modeling" today and join the ranks of top-tier private equity professionals! 🏆

Enroll Now and start your journey to becoming an LBO modeling expert! Don't miss out on this opportunity to elevate your career with Street of Walls. Let's get started!

Course Gallery

Loading charts...