Applied Machine Learning with R (Trading Use Case) - 2020

Why take this course?

🚀 Course Title: Applied Machine Learning with R (Trading Use Case) - 2022📚

Headline: Dive into the World of Quantitative Finance and Master Trading Strategies with Machine Learning Algorithms in R! 🧠🤖

Course Description:

Embark on a comprehensive journey through the exciting realm of quantitative finance and trading with our Applied Machine Learning with R course. This bootcamp is meticulously crafted to elevate you from novice to expert in the quantitative trading workflow, leveraging the full power of R – one of the most robust programming languages for statistical analysis.

🎓 Key Course Elements:

-

Trading Fundamentals: Gain a deep understanding of trading, including the nuanced differences between discretionary and quantitative approaches.

-

Asset Classes Exploration: Get acquainted with various trading instruments/products such as equities, forex, commodities, and indices.

🔧 Data Manipulation Mastery:

-

R Skills Refresher: Brush up on your R programming skills with a focus on quantitative analysis.

-

Market Data Acquisition: Learn to access and load free market data using the

quantmodpackage from sources like Yahoo Finance. -

Data Preparation & Visualization: Master the art of data preparation, visualization, and manipulation tailored for trading data.

💡 Innovative Trading Ideas Generation:

- Trading Idea Incubator: Explore a wide array of trading ideas from online resources and learn how to develop original, data-driven hypotheses.

🧩 Machine Learning Insights:

-

ML for Trading: Unlock the potential of machine learning algorithms to predict market trends, focusing on classification and regression problems.

-

Feature Engineering Workshops: Write sophisticated R codes to engineer features that can significantly improve model predictions.

-

Model Training & Testing: Code along with the instructor to train and test Support Vector Machine (SVM), Naive Bayes, and Random Forest models, specifically applied to predict crude oil futures prices.

📈 Portfolio Optimization Techniques:

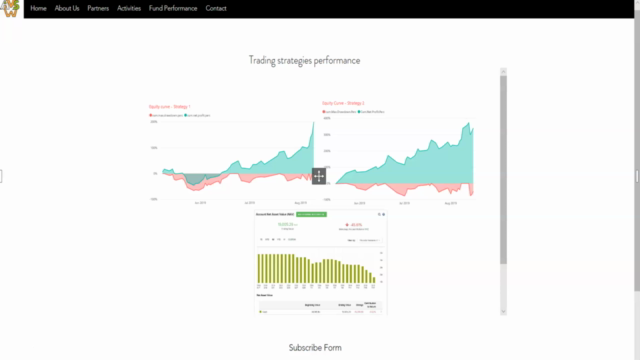

- Strategic Model Selection: Compare model performance and select non-correlated models for a robust trading portfolio.

Disclaimer:

✍️ This course is intended for educational purposes and does not represent trading or investment advice. All teaching materials, content, and codes are shared with the intention of learning and collaboration without any guarantee of precision or completeness.

🔎 Important Note:

-

Past Performance Caveat: No previous performance should be taken as an indicator of future success. The trading strategies discussed in this course are based on hypothetical scenarios and historical backtesting.

-

Risk Consideration: Trading futures, forex, and options carries a significant risk of loss. It is crucial to carefully consider whether trading is suitable for you, considering only risk capital that you can afford to lose. Always consult with financial advisors before making any investment decisions.

Enroll now to transform your data into profitable trading strategies with the power of R and machine learning! 📈🚀

Course Gallery

Loading charts...