CFA Level 2 - Portfolio Management

Why take this course?

🎓 CFA Level 2 - Portfolio Management: Mastery Awaits!

🚀 Prepare with 100% Confidence for the CFA Level 2 Exam!

Are you ready to tackle one of the most critical sections of the CFA Level 2 exam? Our comprehensive course on Portfolio Management is designed to ensure you have a complete understanding of this topic area. Dive into detailed explanations, analyze numerous practice questions, and master the material with confidence. 📚✨

Key Features of the Course:

- In-Depth Syllabus Coverage: Our course meticulously covers all aspects of the Portfolio Management syllabus, from Exchange-Traded Funds (ETFs) to Trading Costs and Electronic Markets. 📈

- Expert Instructors: Learn from experienced CFA Program instructors who bring a wealth of knowledge and real-world insights into the classroom. 🧠

- Extensive Practice Questions: Test your understanding with a wide array of questions from our Learning Ecosystem, as well as End of Chapter questions. There's no better way to solidify your knowledge than through practice! 🤝

- No More Textbooks Required: After completing this course, you won't need to refer back to the textbook or any other sources. We've got you covered! ✅

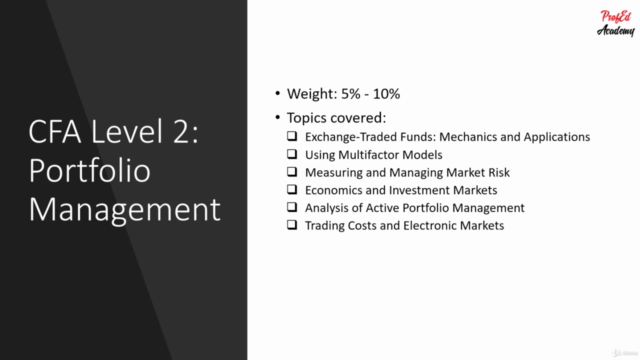

Exam Focus: Portfolio Management (10% - 15% of the Exam)

- Weight of Topic in Exam: The Portfolio Management topic accounts for a significant portion of your CFA Level 2 exam score. Don't miss out on these marks! 🏆

Skills You Will Acquire:

✅ Understand ETFs: Learn the creation and redemption process, trading on secondary markets, costs, risks, and uses in portfolio management. ✅ Master Arbitrage Pricing Theory (APT), Factor Models, and Risk Measurement: Get a handle on macroeconomic, fundamental, and statistical factor models, active vs. tracking risk, and interpret the information ratio. ✅ Expertise in Value at Risk (VaR): Understand the different approaches to VaR, including parametric, historical simulation, Monte Carlo simulations, and their extensions. ✅ Analyze Interest Rate Impact: Learn how changes in default-free interest rates affect market values and understand the fundamental law of active portfolio management. ✅ Execution Costs and Electronic Markets: Gain insights into trading costs, implementation shortfall, market fragmentation, and types of electronic traders. ✅ Risks and Abusive Practices in Electronic Trading: Be aware of the risks associated with electronic trading and abusive practices to ensure you stay ahead of potential issues.

Course Outline:

- Exchange-Traded Funds: Mechanics and Applications

- Using Multifactor Models

- Measuring and Managing Market Risk

- Economics and Investment Markets

- Analysis of Active Portfolio Management

- Trading Costs and Electronic Markets

What You'll Get:

✅ Detailed Syllabus Coverage: Benefit from our seasoned instructors' insights into the CFA Program syllabus. ✅ Supportive Learning Environment: Engage with fellow learners and our instructors in the Q&A forum for course-related questions. ✅ Exam Readiness: Gain the confidence to ace the Portfolio Management topic in the exam!

Join us now and take a significant step towards becoming a CFA charterholder! 🌟🎉

Course Gallery

Loading charts...