Capital Gains Tax Advanced

Why take this course?

🎓 Course Headline: 🚀 Unpack CGT on a More Advanced Level with Capital Gains Tax Advanced by Bizfacility (Pty) Ltd

Course Title: Capital Gains Tax Advanced

Please note that this course is based on South African Tax

Dive deep into the intricacies of Capital Gains Tax (CGT) with our advanced online course, specifically designed for tax professionals and finance enthusiasts who aim to master the complexities of CGT within the South African context. This course goes beyond the basics, offering an in-depth exploration of the principles, practices, and implications of CGT as it relates to income tax.

What You Will Learn:

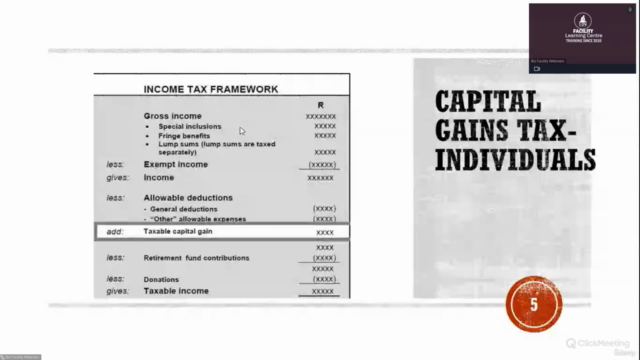

📈 Income Tax Framework - Understand how CGT fits within the broader context of income tax legislation.

🏗️ Capital Gains Tax Structure - Grasp the structure and application of CGT as outlined in the Eighth Schedule to the Income Tax Act 58 of 1962.

🔍 Capital vs. Revenue - Discover the differences between capital gains and revenue for tax purposes.

📄 The Eight Schedule - Delve into the detailed provisions of the Eighth Schedule and how it governs CGT events.

💸 Taxable Capital Gains and Assessed Losses - Learn how to determine what constitutes a taxable capital gain and how assessed losses are treated.

⏱ Disposal and Acquisition of Assets - Understand the principles surrounding the disposal, acquisition, and holding periods of assets.

🚫 Limitation of Losses - Explore the limitations on the deduction of capital losses against income.

💲 Base Cost & Proceeds - Gain clarity on how to calculate the base cost and proceeds for different types of assets.

🏠 Primary Residence Exclusion - Learn about the exclusions available for primary residences and how they impact taxable gains.

📊 Impact of CGT on Income Tax Calculation - Understand the role of CGT in the overall calculation of an individual's or entity's income tax liability.

About the Presenter:

Daniel van Tonder

Daniel van Tonder is not just a seasoned tax professional but also the Head of Taxation at FinSolve Accounting and Taxation, based in Durbanville Cape Town. His expertise is a result of a strategic blend of academic rigor and hands-on experience in the private sector.

After completing his B-Compt degree in Financial Accounting during his articles at Diemont, Zimmerman & Bolink Auditors in Polokwane, Daniel has held esteemed positions as a Group Finance Manager and Group Internal Tax Practitioner. His commitment to professional growth is evident as he currently pursues a postgraduate diploma in taxation through Unisa.

Daniel's standing within the tax community is solidified by his registration as a tax practitioner and his active membership with the South African Institute of Taxation (SAIT). Join Daniel in this advanced course to elevate your understanding of CGT and enhance your expertise in the field of taxation.

Enroll now to unlock the complexities of Capital Gains Tax and take your tax knowledge to the next level! 🌟

Course Gallery

Loading charts...